Dashboard PDF file:

Macro and Markets Dashboard: United States (April 30, 2016 — PDF)

Dashboard update summary:

Markets closed down slightly on the week following inaction from both the Fed and Bank of Japan. Oil and Yen both still became five percent more expensive in dollar terms. Advance estimate 2016 Q1 real GDP growth was weak at 0.6 percent, but in line with expectations. Labor markets continue to be a bright spot, with eyes on next Friday’s April jobs report.

Real GDP ticked up 0.6 percent in log terms in the first quarter of 2016. Personal consumption expenditures and residential fixed investment helped to keep GDP growth positive despite a decrease in nonresidential fixed and inventory investment, and growth in the trade gap. The personal savings rate also increased slightly, in quarterly terms, to 5.2 percent in Q1 from 5.0 percent the previous quarter.

FOMC meeting statement changes are kindly highlighted by the Wall Street Journal and include removal of the language about global risks and, some suggestion in my view, based on labor market growth, household income, and consumer sentiment, of a June rate hike. This would depend on continued labor market strength and price pressure plus an upward revision of Q1 GDP.

Personal consumption expenditures (PCE) continued to increase in Q1, led by higher spending on services. However, monthly data on PCE as a share of GDP decreased slightly in March over its February level. PCE on durable goods as a percentage of GDP was also down slightly in March, to 7.3 percent from 7.4 percent in February.

Labor market data continues to be spotless. The weekly 257,000 new jobless claims is still near the multi-decade low. Next Friday is jobs day. Both the labor force participation rate and wages should continue to improve.

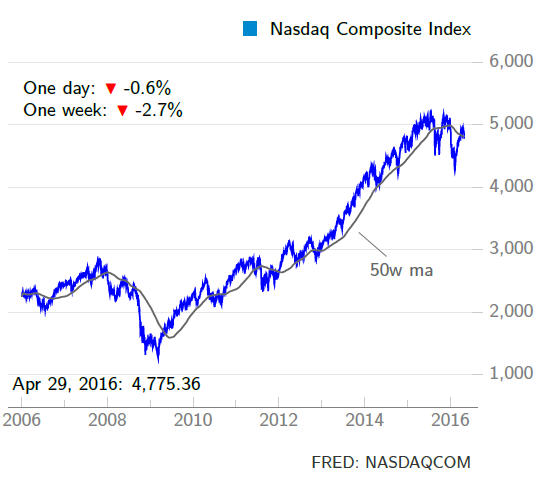

Disappointing earnings data from Apple includes the first decline in iPhone sales nearly since its introduction and a slowdown in sales in China. This hit the Nasdaq particularly hard, as the composite index was down 2.7 percent while the S&P 500 and Dow Jones industrial average fell 1.3 percent each during the week.

Oil prices still managed to climb five percent over the past five days. West Texas Intermediate (WTI) crude oil was trading above $46 a barrel at several points during the week. Two recent stories reminded me how oil price fluctuations cause enormous transfers of wealth between countries. Jamaica was praised in this week’s Alphachat series on sovereign debt, while noting that their recent fiscal fortune is aligned with lower prices on their fuel imports. Likewise, a recent IMF publication noted that oil exporting economies in the middle east and central Asia have enacted powerful fiscal stimulus measures to keep their economies moving while they suffer the oil revenue slowdown. Those who believe in the resource curse might note that government measures to shift the economy away from oil are both important and difficult to achieve.

Lastly, the Yen had a volatile week, closing with a five percent appreciation against the dollar. The Brazilian real appreciated nearly four percent during the week, the Swiss franc and Turkish lira appreciated nearly two percent each, the pound sterling nearly one and a half percent and the Canadian dollar nearly one percent.

The full dashboard is here: Macro and Markets Dashboard: United States (April 30, 2016 — PDF)

One thought on “Dashboard update: Inaction has reactions”