The phrase “investing in America” may be associated with children, infrastructure, or alternatives to pollution. I tend to think about this as changes in the built environment. In other words, what are we letting rot and what are we building?1

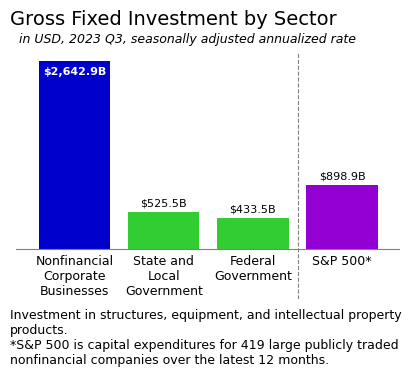

My sense is that many people overestimate the direct role of the public sector in actual investment in the modern US. Of the current $5.8 trillion per year of tangible investment in the US, under a trillion comes from the public sector. Nonfinancial2 corporate businesses invest nearly three times as much as the government (see chart). This is how the US economy is structured; administrative capacity—our ability to do things—is in the private sector. More often, the assumed role of the public sector in the modern US is to encourage investment.

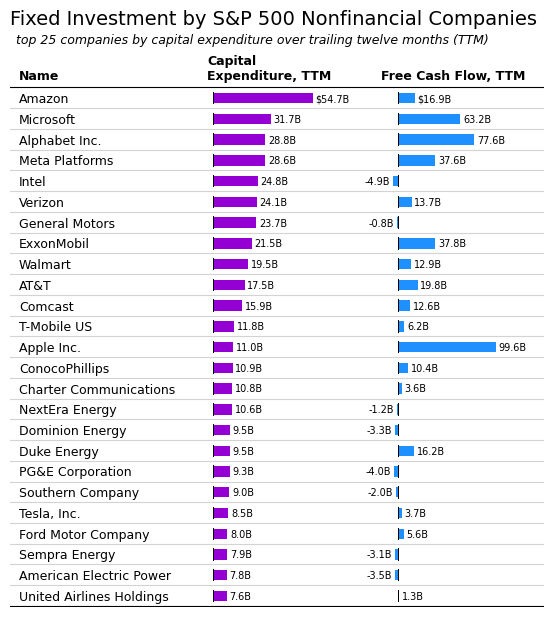

So what investment is actually happening? To get an overall sense of this, we can see which companies are investing the most. In the nonfinancial corporate business sector, a sizable portion of investment is done by publicly-traded companies. Among the 430 large publicly-traded nonfinancial companies in the S&P 500, I could find capital expenditure data for 419. Capital spending at these firms represents about a third of US nonfinancial corporate business investment3.

The top 25 publicly-traded nonfinancial companies by capital spending are included in the table below. Amazon tops the list, with $54.7 billion in capital spending, representing investments in warehouses, data centers, and trucks; Amazon’s HQ2 was completed in 2023. The large tech companies invest in research and development, including AI technologies, but have also been building out domestic production capacity. Automakers have been retooling to produce electric cars. A large number of companies on the list are tied to the boom in oil and gas production.

Whatever your thoughts may be on this list or the types of investment and the national direction it represents, it’s worth pointing out that money is left on the table by running investments in the future through the private sector. Even after making these investments, companies have lots of cash leftover (free cash flow column). This money gets returned to shareholders in an environment where the portion of available income in the economy that goes to workers is already falling.

Ultimately, we really don’t have much of a say about what gets built, under this system. Shareholders can vote for directors but most shares are owned by a small percent of the population and investors don’t often take an active role. Further, the lion’s share of business investment is done by privately-held companies, anyway.

- Specifically gross investment, which is total capital spending and includes both spending to maintain the existing built environment and spending to grow the built environment. ↩︎

- For accounting purposes researchers often exclude financial companies like banks. The concept of capital spending is somewhat less clear for the financial sector. ↩︎

- These measures are not exactly comparable. For example, the national accounts data covers domestic investment, including foreign direct investment, and the S&P 500 is the investment of US companies, including abroad. Instead, the measures provide context for each other in terms of scale. ↩︎