Mismatches between the timing in life of labor income and major expenses cause unnecessary poverty in the US. Labor income (earnings from working) is most common between the ages of 25 and 54 and tends to be highest in amount for people in their 40s and 50s. In contrast, education expenses accrue disproportionately to young adults, and healthcare expenses are higher for the elderly. As another example, new parents tend to have lower wages than parents of teenagers while childcare expenses are very high in the first few years of a child’s life. These mismatches between the timing of income and expenses create financial stress and poverty.

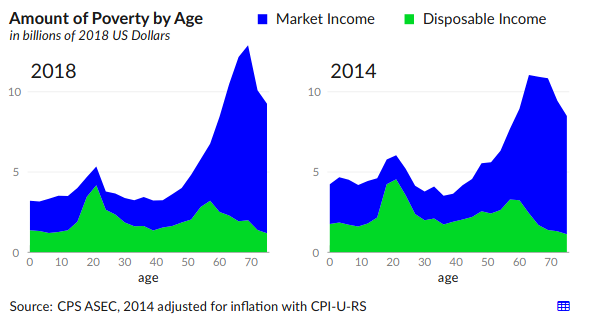

One way to see this is to look at poverty by age:

The blue area shows the dollar amount of poverty reduced by the combined welfare programs and tax credits. The green area shows the amount of poverty remaining after taxes, welfare, and medical, work, and childcare expenses. The large blue area on the right of each graph shows that market income leaves enormous poverty for the elderly, but that this poverty is reduced to below-average rates by programs such as social security, supplemental security, and medicare. These programs are absolutely critical to poverty reduction but still leave some elderly in poverty.

Two age groups that stand out as facing higher-than-average levels of poverty by disposable income are young adults (students and new parents disproportionately) and those before social security retirement/medicare eligibility age. These groups correspond to the bump in disposable income poverty (green area) around age 20 and again around age 60. These age groups are less likely to work relative to 25 to 54 year olds and therefore have less labor income. Unlike 25 to 54 year olds, those who are younger or older have expenses higher than their income, hence the poverty caused by the mismatch in the timing of income and expenses.

Technical note:

Total poverty is defined as the dollar amount of resources that people are below their Census-defined “poverty threshold”. In the case of market income it is the total amount of money that would need to be given to people for their before-tax labor and capital income to equal their poverty threshold, according to the Supplemental Poverty Measure (SPM). Total poverty by disposable income corresponds with the SPM-poverty-rate-based amount of poverty.

One thought on “Poverty and age”